TriCap offers access to different type of insurance solutions

- Private Portfolio Bond

A tailor made flexible Life Insurance Solution for High Net Worth Individuals and Legal Entities, available for different jurisdictions :

- Cayman Islands

- Europe

- UK compliant product

- US compliant Deferred Variable Annuity solution

- Canada Annuity insurance

The above products are available to residents in most countries, including US expatriates conditionally upon being applied for and signed in the Cayman Islands

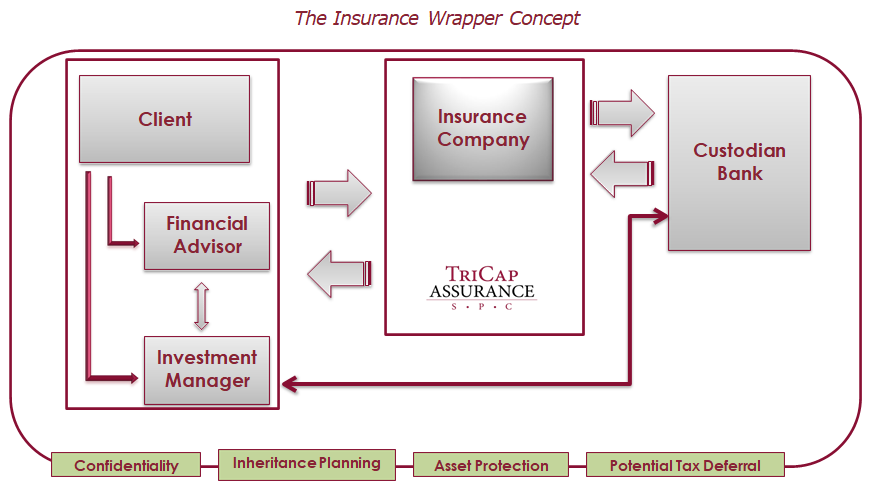

The TriCap Private Portfolio Bond

During the term of the policy

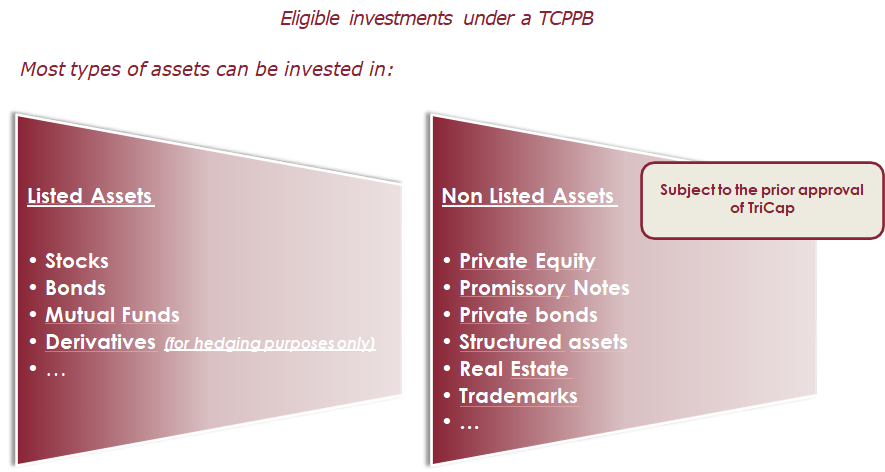

No investments restrictions (incl. Illiquid assets, however it must be limted liabilty assets) provided by law but some restrictions have been put into place by TriCap to avoid excessive risk taking. TriCap's concern is the client's risk exposure;

Insurer becomes the owner of the assets in the policy;

Full protection in case of litigation (divorce, family dispute, etc.);

Tax-free growth of assets in policy (capital gains as wellas income);

Summary of benefits

Transparency and investment freedom;

Right to information at any time;

No tax in policy / tax-free reinvestment;

No reporting obligation for the insurer in event of a claim / pay-out;

Succession planning / pre-defined beneficiaries;

Discretion / Protection from third party access to assets;

Assets segregated from those of the insurance company and the other clients.

Asset Protection Under a TCPPB

Segregated Portfolio of each policy is formalized in a Board meeting, mentioning the custody bank.

The underlying assets in a Segregated Portfolio cannot under any circumstances be used to satisfy liabilities of other clients or of the insurance company.

In case of liquidation of the insurance company, each Segregated Portfolio is protected from creditors and the assets are returned to the policyholder.

The custody bank is specifically selected by the client and may be located in a country other than the jurisdiction of the insurance company.

The Insurance contract cannot be seized or in any other way impounded by any third party.

No Creditor has access to the assets since they are the legal ownership of the Insurance Company. This implies that the assets cannot be seized.

TriCap cooperates almost exclusively with a limited number of selected Luxembourg based Custodian Banks. The proximity and the international orientation of the Luxembourg banks have proven to be major arguments to maintain that strategy.

No investments restrictions (incl. Illiquid assets, however it must be limted liabilty assets) provided by law but some restrictions have been put into place by TriCap to avoid excessive risk taking. TriCap's concern is the client's risk exposure;

Insurer becomes the owner of the assets in the policy;

Full protection in case of litigation (divorce, family dispute, etc.);

Tax-free growth of assets in policy (capital gains as wellas income);

Summary of benefits

Transparency and investment freedom;

Right to information at any time;

No tax in policy / tax-free reinvestment;

No reporting obligation for the insurer in event of a claim / pay-out;

Succession planning / pre-defined beneficiaries;

Discretion / Protection from third party access to assets;

Assets segregated from those of the insurance company and the other clients.

Asset Protection Under a TCPPB

Segregated Portfolio of each policy is formalized in a Board meeting, mentioning the custody bank.

The underlying assets in a Segregated Portfolio cannot under any circumstances be used to satisfy liabilities of other clients or of the insurance company.

In case of liquidation of the insurance company, each Segregated Portfolio is protected from creditors and the assets are returned to the policyholder.

The custody bank is specifically selected by the client and may be located in a country other than the jurisdiction of the insurance company.

The Insurance contract cannot be seized or in any other way impounded by any third party.

No Creditor has access to the assets since they are the legal ownership of the Insurance Company. This implies that the assets cannot be seized.

TriCap cooperates almost exclusively with a limited number of selected Luxembourg based Custodian Banks. The proximity and the international orientation of the Luxembourg banks have proven to be major arguments to maintain that strategy.

Want to know more ?

TRICAP ASSURANCE S.P.C.

Governors Square, Blvd 4, 2nd Floor

23 Lime Tree Bay Avenue

P.O. Box 32315

Grand Cayman

KY1-1209 Cayman Islands

info@tricapassurance.com

Governors Square, Blvd 4, 2nd Floor

23 Lime Tree Bay Avenue

P.O. Box 32315

Grand Cayman

KY1-1209 Cayman Islands

info@tricapassurance.com